Getting Back to the Middle

In my last post, I talked about the difference between the type of development being provided and the type of development people want - small scaled homes and communities with access to shared amenities, which is usually provided by a product that is inherently fixed in total amount: Existing Historic Urban Development.

10065 - The most expensive zipcode in the US without a beach or a mountain. Most of these buildings are at or near 100 years of age.

Why can't we figure out how to provide more of what so many people consistently pay so much money for?

Because it's the path of least resistance for development, due to barriers of our own making. It is baked in to the way we plan and the way we finance new residential and commercial development.

Let's start with planning:

The immense urban growth following WWII was shaped by the dominance of the auto industry in American life, as was the American economy, the American psyche, etc. The future of America was a car for everyone, to go everywhere.

We are still planning and designing our cities looking toward that future of the 1950s.

The future is now!

We based parking requirements on absolute peak demand - so that even on Black Friday, everyone, by law, gets a parking space. Developers were forced to buy more land, and provide worst-case scenario parking, for free, in order to build. With more than ample parking everywhere, more people choose to drive for trips. Traffic engineers note the roads are getting congested, and design larger, wider roads to provide capacity.

Cities limit density so that there is room for all these wider roads to carry all the cars, pushing houses and businesses farther and farther apart so that the need to drive is increased, adding more drivers. Now that parking lot that rarely filled up 10 years ago is always full. We need to raise parking requirements again! And the cycle continues.

So now, we can't just build apartments - we have to provide free parking for everyone and their families on Thanksgiving, and throw in a gym, a pool, and some entertainment options because I don't want to sit in traffic for 30 minutes to get some exercise or see a movie.

Today's developers have to build 100s of units at a time to subsidize all of these things "for free" to make their numbers work.

This cycle has been spinning for decades, and now, this is what banks are used to seeing. And big national banks that don't have much skin locally only like what they are used to seeing.

AND YET, sellers continue to command a premium for smaller-scale finer-grained historic development.

Add to that historic home-flippers that turn old duplex, triplexes and multiplexes into giant single-family mansions most of us will never afford.

But these antiquated multiplexes provide the savings of communal living at a scale that is optimally desirable for a majority people, as the Ikea study previously showed. Similarly, the local stores, bars, gyms, parks, and restaurants are communal amenities that are universally desired, to the point that they need to be artificially created within giant apartment complexes.

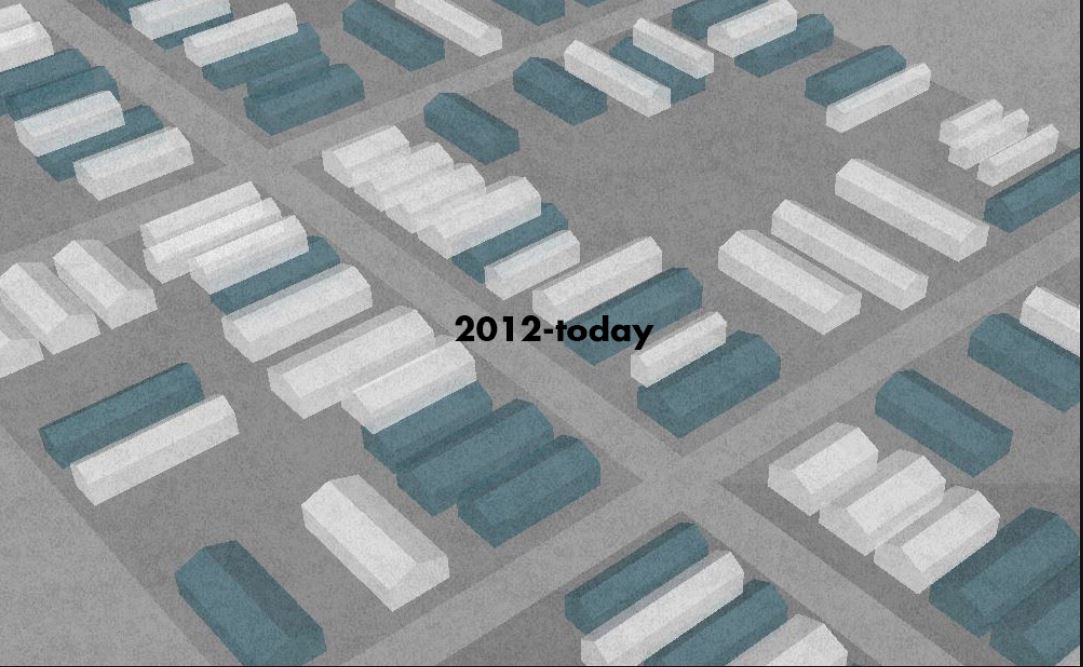

The type of building stock that supports properly sized communities is endangered. This "middle-sized" urban setup is somewhere in between the 100-unit block and the single family mansion. The first step to create awareness of a problem is to give it a name, and fortunately one was coined by Daniel Parolek in 2010:

THE MISSING MIDDLE. It is a vanishing commodity in increasing demand... in other words, a financial home run.

Read more about the Missing Middle here.

Check out how cities around the country have already identified and begun to implement change to grow the Missing Middle: Olympia, WA - Austin, TX - Minneapolis, MN - San Diego, CA.

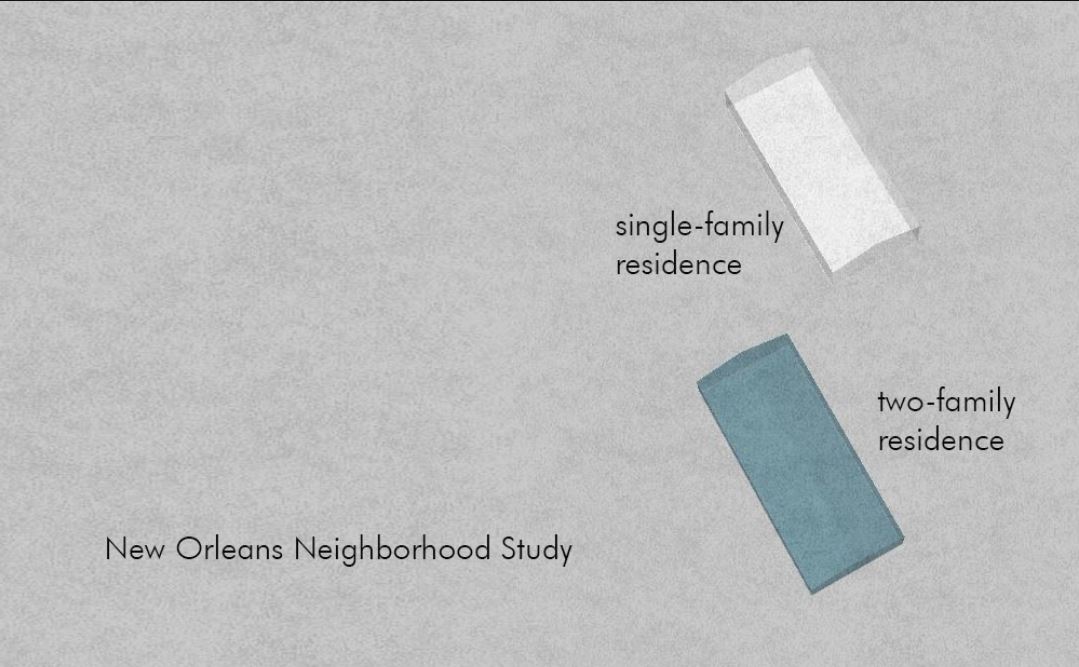

In our historic neighborhoods of New Orleans, the old barriers to new Missing Middle development are being rolled back and we need small developers to lead the charge.